The only way to access cash faster is with a new loan: a cash-out refinance, a home equity loan or a home equity line of credit (HELOC). Once you pay extra mortgage principal, you can’t just ask your lender to give it back if you’re short on cash. Increased borrowing costs if you need the money later.Saving for retirement, paying off debt or even taking a vacation to visit family might be better uses of your money. More frequent mortgage payments means less money for other things.

You might find it easier to manage your income and expenses by matching them up this way, especially if your housing payment is your largest expense. If you get paid biweekly, you might prefer to pay your mortgage biweekly as well. Using the previous examples, you’d pay off your loan in about 25.5 years and a little over 26 years, respectively. Accumulate equity faster by paying more principal and you’ll be mortgage free sooner. If you have a $200,000 mortgage at 3% for 30 years, biweekly payments will save you $14,280. If you have a $300,000 mortgage at 4% for 30 years, biweekly payments will save you $35,000 in interest payments. The higher your interest rate and the more you’ve borrowed, the more you could save.

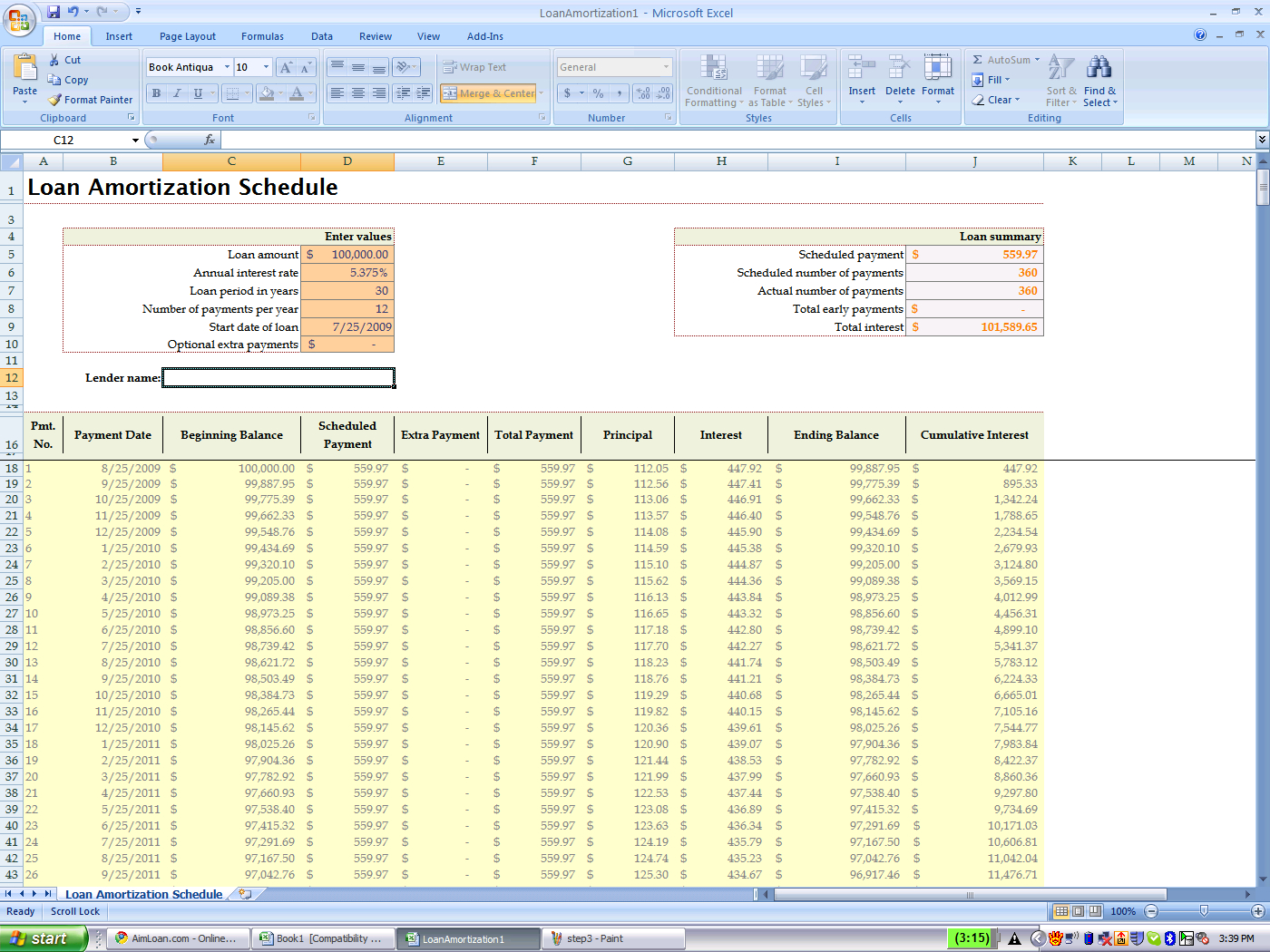

#Mortgage calculator with extra payments biweekly how to#

But your plan might not work out as well as you expect if you don’t understand how to manage the downsides. Paying less interest and getting out of debt faster are enticing reasons to make biweekly mortgage payments. Pros and Cons of Biweekly Mortgage Payments

0 kommentar(er)

0 kommentar(er)